Caché Realty Capital is an investment and advisory firm focused on structured finance for complex commercial real estate projects across a wide spectrum of asset types. Based in Dallas, Texas, our firm actively seeks opportunities across the United States.

Our resources provide the capability to pursue financing transactions in which we participate as a Principal Investor, Advisor/Intermediary or an Asset Manager. Preferred clients are partners with whom we can co-invest.

Caché Realty Capital will consider investing in value-add acquisitions, recapitalizations, distressed situations and ground-up development.

Caché Realty Capital’s success is fueled by a unique blend of deep-rooted relationships in the capital markets along with powerful insight into evolving trends and changing market conditions. Through an experienced lens, we make confident decisions from a position of strength forged by over 40 years of experience and performance on billions of closed real estate transactions.

The firm’s definitive culture is based on a history of protecting capital while adding value for Investors, Clients and Partners. We consider success as the result of discerning and deliberate pursuit. Our participation in transactions is always with the goal of being an accretive Team Member, arranging capital, providing data-driven solutions and recommendations while sharing the financial risk and gains alongside our Partners.

Pictured above is Scott Lynn, Founder & Principal, and Christi Stroup, Managing Director.

Scott Lynn, Founder and Principal of Caché Realty Capital, is a commercial real estate veteran, investor, entrepreneur and financier. With more than 40 years in commercial real estate, Scott has navigated multiple real estate cycles making him uniquely adept at identifying opportunities and adjusting strategies to leverage changing market conditions.

Scott founded Metropolitan Capital Advisors (MCA) in 1992 as a commercial real estate investment banking firm focused exclusively on the representation of developers, investors and property operators in the real estate capital markets. Over its 28 year history, MCA arranged in excess of $16 billion of financing for all property types before the firm was acquired by Marcus & Millichap in April 2020. Metropolitan Capital Advisors was consistently ranked under Scott’s tenure as a Top 25 Finance Intermediary by National Real Estate Investor Magazine.

Scott has a long history of investing alongside his clients in a variety of investment structures that include direct equity, preferred equity and mezzanine loans. On behalf of his family limited partnership as well as third party investors, Scott currently manages a portfolio of diversified commercial real estate investments in land, shopping centers, office buildings, for-sale housing, senior care and multifamily.

The Dallas Business Journal has consistently recognized Scott as one of the top Commercial Real Estate Financiers in the market. Additionally, he also has been recognized as a “Top 25 Heavy Hitter All-Star” by the North Texas Commercial Association of Realtors (NTCAR).

Scott is a native Dallasite, a graduate of the University of Texas at Austin and is a member of numerous professional organizations including ICSC, ULI, NTCAR, the UT Austin Real Estate Finance and Investment Center (REFIC). Scott currently serves as an Executive Board Member for the Real Estate Capital Alliance (RECA).

Christi Stroup is a commercial real estate investor, developer, and family office veteran. With over 25 years in commercial real estate investment, Christi is an experienced leader in acquisition, financing, asset and money management.

Christi was the Executive Vice President of Swift Property Company, a Dallas-based family office focused on equity investments in commercial real estate developments. During her 14 years of leadership, Christi provided expertise in due diligence and relationship management from acquisition through property disposition.

From 1990 to 2006, Swift Property Company was involved in the capitalization of over $2 Billion in real estate across multiple states and property types including multifamily, industrial, office, medical office, single-family residential, retail, hospitality, and leisure sports. Christi negotiated partnerships, financing and strategic workouts for successful growth in the economic positions of the family office.

In 2006, Christi demonstrated her willingness to accept shared risk-taking by developing single-family lots in North Texas. Following the Great Recession and the resurgence of the capital markets, Christi participated in CMBS securitizations, including underwriting and due diligence review of over $500M CMBS and Agency contracts for multifamily, retail, hospitality, medical and office properties.

Most recently, Christi worked with Argentic Services Company LLC, a newly formed CMBS and CLO special servicer based in Texas. Christi was instrumental in the company’s revenue recognition and ratings confirmation.

Christi is a graduate of Texas A&M University, a Texas Certified Public Accountant (currently inactive status), and a Texas Real Estate Broker. Christi has served on the Board of Directors for her local Rotary Club.

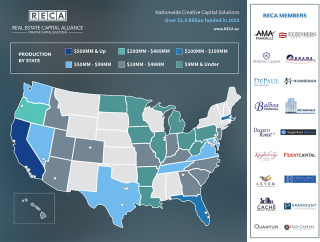

Caché Realty Capital is a member of the Real Estate Capital Alliance (RECA), a national association of 20 boutique real estate capital advisory firms with offices in major metropolitan markets across the United States. CRC’s association with RECA gives our firm national reach in every product type along with real time access to the top capital markets providers.

Membership, Affiliations & References:

Caché Realty Capital has participated as a co-sponsor, investor and/or advisor on a broad spectrum of investment structures and property types across the United States.